Austin Best of the Best Awards

We are honored to be named Austin’s Best Credit Union for four years in a row in the Credit Union category! Thank you for making this achievement possible and trusting us as your financial institution. Austin Telco will continue providing our members with outstanding rates and services for all their financial needs.

2022 Annual Meeting | Board of Director Nomination Process

Next March, three members will be elected to serve on the Board of Directors. The election process will be conducted in compliance with our Bylaws and Election Rules with the election taking place at the Annual Meeting on Wednesday, March 8th, 2023 at the Balcones Centre building 4th floor training room, starting at 2:00 p.m.

A Nominating Committee, appointed by the Chairman of the Board, will select and present nominees to the membership. Members seeking consideration for nomination by the Nominating Committee must submit a resume and current photo as well as complete an “Application for Nomination to the Board of Directors” form by Thursday, November 10th, 2022. If the number of nominees equals the number of positions to be filled, other members may seek nomination by petition. There will be no nominations from the floor at the Annual Meeting. Any member seeking nomination by petition must submit a “Nomination by Petition Packet” along with a resume and current photo by Wednesday, January 11th, 2023. Applications and “Nomination by Petition Packets” will be available during normal lobby hours Monday thru Friday on the 4th floor of the Administrative Office in the Balcones Centre building located at 11149 Research Blvd., Austin, TX, 78759. All required documents noted above must be filed with the Nominating Committee by the specified deadline by delivering them to the 4th floor of the Administrative Office in the Balcones Centre building, Monday thru Friday, 8:30 a.m.- 3:30 p.m.

In order to vote in an election of the Credit Union, an individual must be: 1) a member having qualified within the Credit Union’s defined field of membership as set forth in the Credit Union’s Bylaws and 2) must own a regular share account as a primary member with a balance equal to or in excess of the minimum balance requirements of the account classification. Joint owners of accounts are not eligible to vote unless they qualify as a member and have account in their own right. Members are not eligible to vote until having attained eighteen (18) years of age.

Names of members placed in nomination will be posted by Wednesday, February 1st, 2023.

What are Share Certificates and How are they Beneficial?

For many, managing investments and finance can be stressful or even overwhelming. But it doesn’t need to be this way. Author Robert Kiyosaki once said, “Let the money work for you.” Such a simple adage gets to the heart of money management and what it hopes to achieve - growing your wealth without overextending yourself. Ideally, without any additional work at all.

So what do share certificates have to offer? In short, they are designed for those who want to build their existing cash balance into more wealth over time with ease and minimal effort.

Share certificates offer a fixed dividend rate with a set time commitment, after which the initial deposit and any dividends earned are returned in full. With their fixed dividend rates and at least $250,000 worth of insurance courtesy of the NCUA, they are often seen as one of the most secure investment strategies available.

In many ways, share certificates are similar to other long-term savings accounts, like CDs. However, the main difference between CDs and share certificates is that share certificates are offered by Credit Unions like Austin Telco Federal Credit Union, while CDs are offered by banks. In addition, credit unions, unlike banks, are member-owned and non-profit in nature. Credit Unions utilize their profits to offer high-quality, competitively rated options for their members, as well as better dividend earnings on the share certificates they offer.

People often use these accounts for planning purposes, whether for graduations, future vacations, or a nest egg for later in life. Think of it as putting money away in a safe, where it keeps multiplying and compounding upon itself. Whatever your goal, share certificates are a great way to grow your wealth without having to do any additional leg work yourself. Simply put the money aside and watch it grow!

Credit Union House

Visa NFL Sweepstakes

This could be your dream NFL season! When you pay with your Austin Telco FCU Visa card, or any other Visa card from 9/1/22 – 10/31/22, you’ll be entered for a chance to win a trip to Arizona for Super Bowl LVII that’ll keep you cheering all season long. Tap to pay with a Visa contactless card or a Visa card with a payment-enabled device for a bonus entry.

Grand Prize Package includes:

- 2 round-trip flights to Arizona

- 2 tickets to Super Bowl LVII

- Hotel accommodation

International Credit Union Day

On October 20, 2022, Austin Telco Federal Credit Union will join over 56,000 credit unions around the world to celebrate International Credit Union (ICU) Day. The theme of ICU Day 2021 is “Empowering your financial future”

Credit unions were built on the principle of “people helping people.” We’ve seen that philosophy in action for more than 100 years, with credit unions providing access to affordable financial products and striving to meet the needs of underserved communities. Austin Telco is honored to be a part of this proud tradition.

Privacy Policy

Austin Telco Federal Credit Union respects the privacy of our members. We recognize the importance of maintaining the confidentiality of your personal financial information. The privacy policy describes the practices followed by Austin Telco Federal Credit Union. The privacy policy explains what types of member information we collect and under what circumstances we may share it.

You can view our privacy policy online by clicking here.

Skip-A-Pay

Starting Tuesday, October 11th, Austin Telco’s Skip-A-Pay program can add some room to your holiday budget by allowing you to skip your loan payment(s) in the month of November or December.

There are several ways to set up Skip-A-Pay for your loan:

- Online - go to our Skip-A-Pay page and fill out the form

- Complete the Skip-A-Pay coupon and mail or fax it to:

Austin Telco Federal Credit Union

11149 Research Blvd., Suite 300, Austin, TX 78759

Fax: 512-302-3333 - Submit the coupon in person at any of our branch locations starting Tuesday, October 11th.

The Skip-A-Pay coupon must be received before your payment is due. The following loans are excluded from this offer: Real Estate, Home Improvement, Home Equity, Term Loans, and Business Loans. Visa Skip-A-Pay coupons are due by October 28, 2022, to skip November 25, 2022, or November 29, 2022, to skip December 25, 2022. Please note that interest is still accrued when payments are skipped, and the term is extended. Normal qualifying is required. Skip-A-Payment is only available for current loans made before July 1, 2022, with no extensions within the past 12 months. One payment that is due between November 15, 2022, and December 31, 2022, may be skipped. Maximum extension is 30 days.

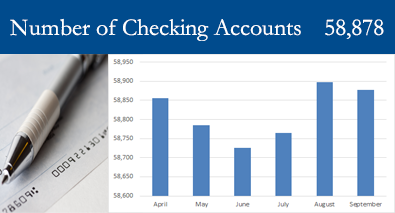

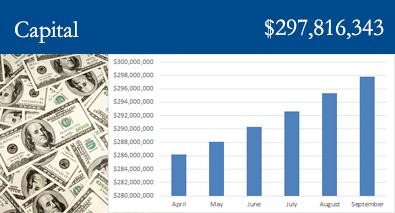

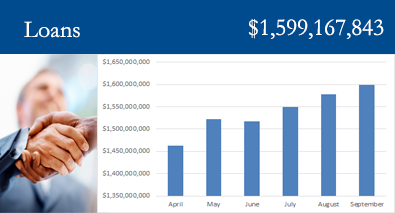

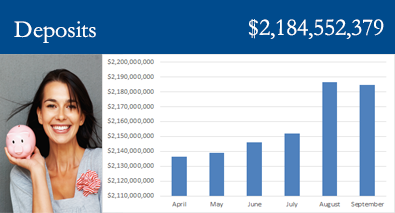

Statistically Speaking

As of September 30, 2022